Online businesses are constantly seeking ways to cut costs and enhance their customer experience. One of the most significant factors impacting profitability is payment processing fees, which can eat into revenue. Crypto payment gateway are revolutionizing the industry by offering substantially lower fees compared to traditional payment systems. In this CoinPay article, we’ll provide a comprehensive look at various crypto payment gateway fees and explore how CoinPay can minimize your business’s payment expenses.

Why Crypto Payment Gateway Fees Matter

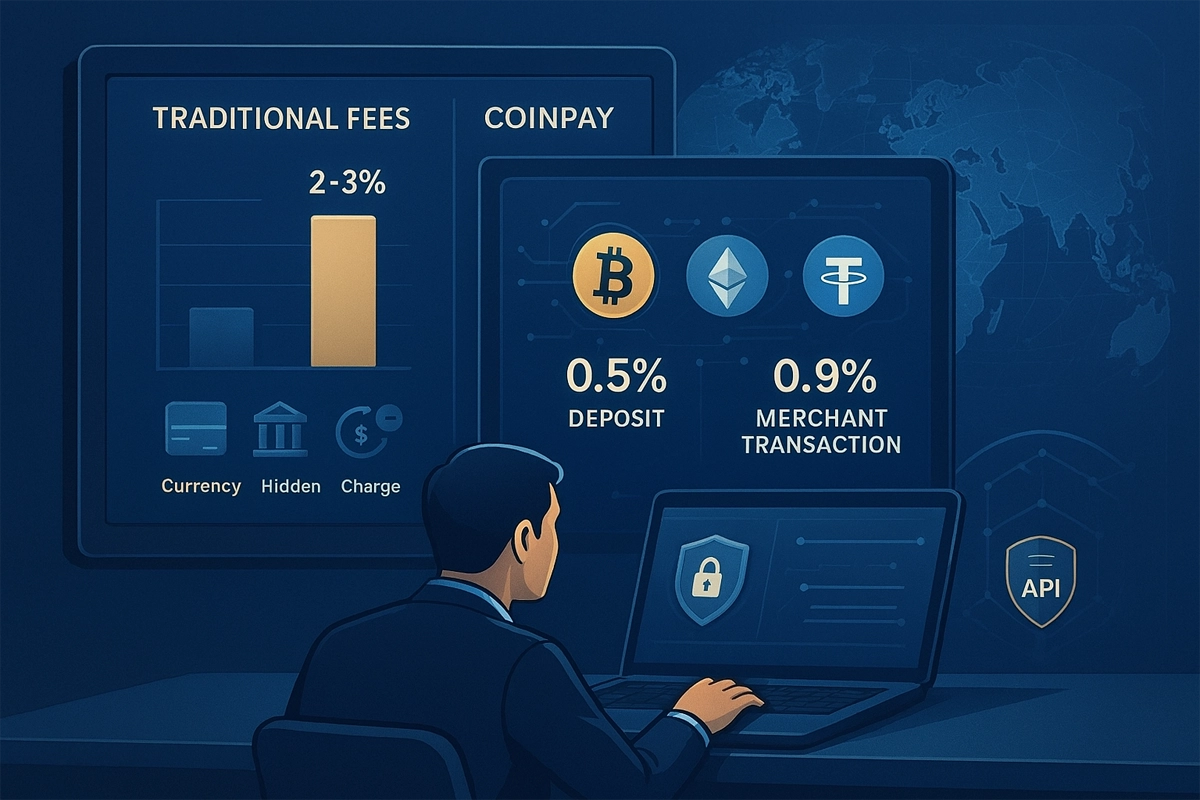

For online businesses, payment processing fees directly impact profitability. Traditional gateways like credit card processors often charge 2–3% per transaction plus fixed fees, alongside hidden costs such as currency conversion charges, chargebacks, and monthly maintenance. These expenses can erode margins, especially for SMEs and global merchants.

By contrast, crypto payment gateways leverage blockchain technology to reduce intermediaries, offering transparent, lower-cost solutions that empower businesses to scale internationally.

Analyzing Traditional Payment Gateway Fees

Traditional payment gateways, primarily based on credit cards and banking systems, charge businesses considerable fees. These typically include a percentage of the transaction amount plus a fixed fee per payment. For small and medium-sized businesses, these costs can significantly impact profit margins.

Beyond the main fees, traditional gateways often come with other hidden costs. These can include international transaction fees, currency conversion charges, chargeback fees, and monthly account maintenance fees. For businesses dealing with international clients, these expenses can skyrocket.

Another issue with traditional gateways is a lack of transparency in their pricing structures. Many businesses find themselves paying additional charges they weren’t initially aware of, beyond the advertised fees.

One of the most significant benefits of crypto payment gateways is the absence of hidden fees. Most of these gateways boast transparent and straightforward pricing models, helping businesses better forecast and budget their expenses.

Furthermore, crypto payment gateways generally don’t differentiate between domestic and international transactions. This means businesses working with overseas customers don’t incur extra charges for cross-border payments.

| Gateway Type | Typical Fees | Hidden Costs | International Charges |

|---|---|---|---|

| Traditional gateways | 2–3% + fixed fee | Chargebacks, conversion, monthly fees | High (currency + bank fees) |

| Crypto gateways | 0.5–2% | None | Equal domestic & international |

Popular Crypto Payment Gateways Fees

International cryptocurrency payment gateways charge varying fees for crypto transactions. These fees are separate from blockchain network fees and are charged by the gateways for infrastructure and network support.

CoinGate

CoinGate charges a 1% fee, with a €0.25 fee for chargebacks and a 0.1% conversion fee. It’s a suitable option for small and medium-sized businesses.

CoinsPaid

CoinsPaid offers some of the lowest fees among payment gateways and supports over 20 cryptocurrencies. It also enables the conversion of digital assets into more than 40 fiat currencies.

Cryptomus

Cryptomus typically charges around 2% for transactions and has no minimum withdrawal amount, offering high flexibility for small transactions.

NOWPayments

NOWPayments has a 1% fee and supports over 75 cryptocurrencies with an auto-conversion option. This gateway is ideal for businesses needing a wide variety of digital currency options.

Factors Influencing Crypto Payment Gateway Fees

Several factors influence crypto payment gateway fees, understanding which helps businesses make the best choice.

Transaction Volume

Monthly transaction volume is a primary factor determining fee rates. Businesses with higher volumes can often negotiate lower fees. This is particularly important for large businesses and rapidly growing companies.

Type of Cryptocurrency

The type of cryptocurrency used also impacts fees. Different cryptocurrencies have varying network fees, which can affect the final gateway fee. Some cryptocurrencies have lower network fees, allowing gateways to charge less.

Transaction Confirmation Speed

Transaction confirmation speed is another crucial factor. Gateways guaranteeing faster confirmations might charge slightly higher fees, but this speed can be invaluable for businesses.

Comparing Domestic vs. International Transaction Costs

A standout advantage of crypto payment gateways is their equal treatment of domestic and international transactions. This feature is especially beneficial for businesses operating in global markets.

In traditional payment systems, international transactions often incur additional fees, including currency conversion costs, intermediary bank charges, and international transfer fees. These can add up significantly.

Crypto payment gateways, by eliminating intermediaries and leveraging blockchain technology, facilitate international transactions at consistent fee rates. This enables businesses to offer their products and services globally at a lower cost.

The Impact of Lower Fees on Business Profitability

Reduced payment processing fees can directly and significantly boost business profitability. This saving is especially crucial for businesses with high transaction volumes.

The savings from lower fees can be reinvested into various business areas like marketing, research and development, or improving product and service quality, fostering growth and development.

Moreover, lower operational costs can allow businesses to offer more competitive pricing. This is particularly advantageous in competitive markets where price heavily influences customer decisions.

CoinPay: Competitive Fees for Your Business

As a leading cryptocurrency payment gateway, CoinPay offers a highly competitive and flexible fee structure. Understanding the diverse needs of businesses, CoinPay provides varied pricing solutions.

A key feature of CoinPay is the absence of setup fees or fixed monthly charges. This pay-as-you-transact model supports startups and new businesses, allowing them to use the gateway services without worrying about fixed costs.

Pricing transparency is another CoinPay advantage. The gateway clearly states all transaction-related costs, with no hidden fees. This transparency allows businesses to accurately calculate and plan their expenses.

Support for Diverse Cryptocurrencies

CoinPay supports a wide range of cryptocurrencies, including popular ones like Bitcoin, Ethereum, and Tether. This diversity allows businesses to attract customers with different preferences while benefiting from the varied fees associated with each currency.

Accepting multiple cryptocurrencies also helps businesses diversify their risk against the price volatility of any single digital currency, contributing to financial stability.

Security and Trust at CoinPay

CoinPay employs top-tier security standards to protect business data and assets. The gateway utilizes advanced encryption technologies and modern security protocols to ensure transaction security.

The use of blockchain technology in CoinPay makes transactions immutable and transparent. This feature assures businesses that their transactions are secure and verifiable.

CoinPay also features continuous monitoring systems that detect and block any suspicious activity, helping safeguard businesses against cyber threats.

Ease of Use and Setup

One of CoinPay’s significant advantages is its user-friendly setup and operation. The gateway is designed to be easily usable even by businesses with limited cryptocurrency experience.

CoinPay provides comprehensive documentation and step-by-step guides for setting up the payment gateway, including practical tutorials and tips for optimizing performance.

CoinPay’s robust API facilitates seamless integration with websites, mobile applications, and other business systems. The API is designed for easy implementation by developers.

Conclusion

Choosing the right payment gateway can profoundly impact a business’s profitability and growth. Crypto payment gateways, with their lower fees, greater transparency, and advanced features, present an attractive option for modern businesses.

CoinPay offers a comprehensive solution for business payment needs by combining competitive fees, high security, and ease of use. This payment gateway helps businesses reduce their costs while providing a better customer experience.

Given the increasing adoption of cryptocurrencies and growing business awareness of their benefits, crypto payment gateways are expected to play an even more significant role in the future of e-commerce.

Learn More: Tether Payment Gateway

Frequently Asked Questions

What are the fees for using CoinPay’s crypto payment gateway?

CoinPay does not have a fixed fee; costs decrease based on monthly transaction volume.

Does CoinPay charge monthly or fixed fees?

No, CoinPay only charges a fee on successful transaction withdrawals.

Does CoinPay convert cryptocurrency to fiat currency?

Yes, CoinPay converts cryptocurrencies to fiat currencies like USD or Toman and deposits them into the business owner’s bank account.

Is using CoinPay cost-effective for international businesses?

Yes, CoinPay provides suitable gateways for businesses of all sizes and integrates them with your website.